The Spokane multifamily market is rapidly changing due to rising interest rates, new policies, and cooling rent growth.

By Jordan Lester

The Spokane multi-family market is rapidly changing due to rising interest rates, new policies, and cooling rent growth. But, even in an unpredictable and rapidly changing economy, apartments remain a strong and stable asset due to predictable income and continued appreciation.

I have analyzed current market trends extensively and have broken them down into 5 comprehensive categories: Rising Interest Rates, New Multi-Family Zoning Ordinance, Multi-Family Tax Exemption Program, Cooling Rent, and CRE vs the Stock Market.

Rising Interest Rates:

- Interest rates increased by 75 basis points on September 21st, marking the 5th rate hike in 2022 totalling 300 basis points for the year (3%) on the Fed Funds rate

- Interest rates have eclipsed 7% on 30 year fixed mortgages, the highest rates we have seen since 2008

- The increase in interest rates has impacted multi-family commercial real estate deals by requiring buyers to put more cash down than normal, in addition to making owner financing and assumable debt more attractive and important to understand

- Owner financing: A process where the seller finances the transaction instead of a bank, usually at a lower rate than market interest rates

- Owner financing can benefit buyers by allowing them to borrow money at lower interest rates, but can also benefit sellers by allowing them to collect monthly interest payments as a source of cash flow. Owner financing can benefit both parties by allowing a quicker close and less traditional mortgage requirements, such as minimum down payment

- Assumable debt: Allows buyers to take on the current loan the owner has in place for the property, which also allows buyers to borrow money at lower interest rates

- Debt coverage ratio is another important metric to understand for financing purposes

- Debt coverage ratio equals the annual net income divided by the annual debt servicing, and a good rule of thumb is that banks will only lend on properties that produce a 1.25 debt coverage ratio or higher

New Multi-Family Zoning Ordinance:

- Due to a lack of housing, the Spokane City Council passed a temporary one year ordinance on July 18th of this year to increase housing density and allow for multi-family construction of duplexes, triplexes, and fourplexes on single family zoned properties

- Spencer Gardner, Spokane’s planning director, said they hope to make this change permanent before the one year ordinance is up next July

Multi-Family Tax Exemption Program:

- On August 15th, 2022, the City of Spokane updated the Multi-Family Tax Exemption Program to create more tax incentives for developers

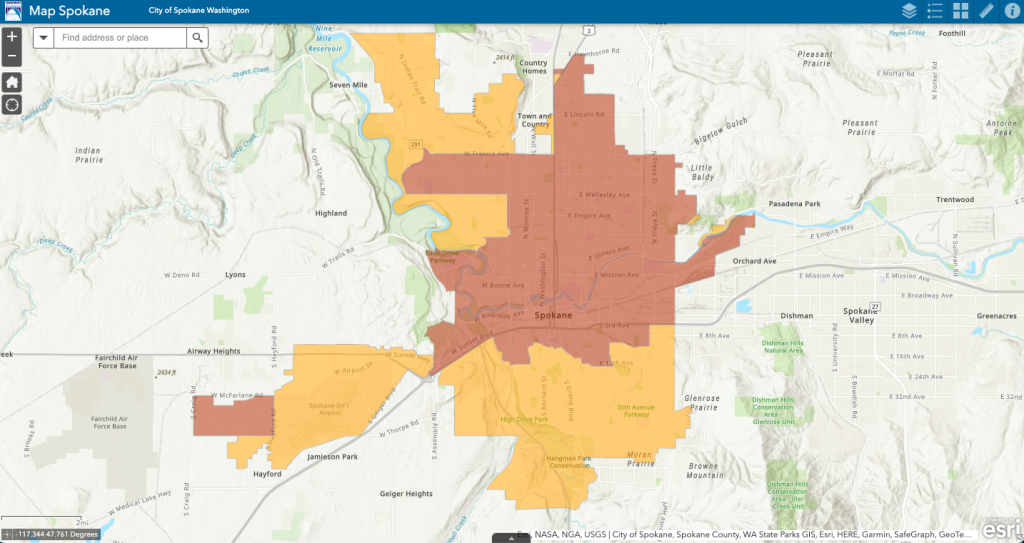

- The two areas of Spokane where this program is in effect are the Spokane Targeted Investment Area (STIA) and the Affordable Housing Emphasis Area

- The Spokane Targeted Investment Area (highlighted red in the map below) consists of 34 economically distressed census tracts. The goal of the STIA is to encourage market rate housing in areas with high poverty rates, leading to a greater blend of incomes and housing types

- The Affordable Housing Emphasis Area (highlighted orange in the map below) is intended to encourage the development of affordable housing with income and rent restrictions

- Developers can expect to save about $1,166 on their tax bills for every $100,000 of assessed value on the building portion of their properties

- 8 year exemptions are given to units consisting of student housing and congregate living housing, 12 year exemptions are given to units consisting of low/moderate income households, and 20 year exemptions are given to units that consist of portions being sold to qualified nonprofit or government partners that will guarantee permanent affordable housing

Cooling Rent:

- After historic rent growth of 23% in Spokane over the last two years (Q2 2020-Q2 2022), rent growth has cooled and actually showed a slight decline of 0.9% in rent growth during Q3 2022

- This slight decline is an indication of rent growth plateauing due to the unsustainable growth of the last two years

- While rent growth is certainly cooling off, the demand for rentals in Spokane remains strong due to higher interest rates pricing homebuyers into the rental market

Commercial Real Estate Compared To the Stock Market:

- The S&P 500 (the stock performance of 500 leading publicly traded companies in the United States) increased by 27% in 2021 and has decreased by 24% so far in 2022

- The commercial real estate market experienced growth in all sectors in 2021 and has continued to experience growth in all sectors in 2022

- The commercial real estate market is significantly less volatile than the S&P 500, and historically has proven to be a more stable asset than the stock market

In conclusion, the multi-family market in Spokane continues to evolve, but apartments remain a strong asset for investors. After seeing historically low interest rates the last two years due to COVID-19, interest rates have increased significantly over the last six months, making it more difficult for commercial real estate deals to pencil out for investors, but also creating less competition and more negotiating power for investors looking to purchase apartments. Spokane has recently put two new policies into place in order to increase housing density and in order to incentivize developers to build in lower income areas. While rent growth has cooled, the rental market remains strong because higher interest rates have priced home buyers into the rental market.

I would love to help you navigate the current multi-family market and help you achieve your commercial real estate goals. Reach out to me if you are interested in buying or selling apartments in Spokane: 509-496-6922

Jordan Lester is an Associate Advisor with SVN Cornerstone. Jordan served as a brokers assistant for 3 years with SVN Cornerstone before becoming a full time broker. Jordan specializes in the multi-family sector of commercial real estate.

Referenced Articles:

Federal Funds Rate History 1990 to 2022

Cities Look To Turn Backyards Into Apartments To Ease Housing Shortage

‘Suddenly, there’s options’: Spokane City Council OKs one-year zoning change allowing multi-family housing, townhouses in all residential zones

Multi-Family Tax Exemption

Commercial Real Estate vs S&P 500