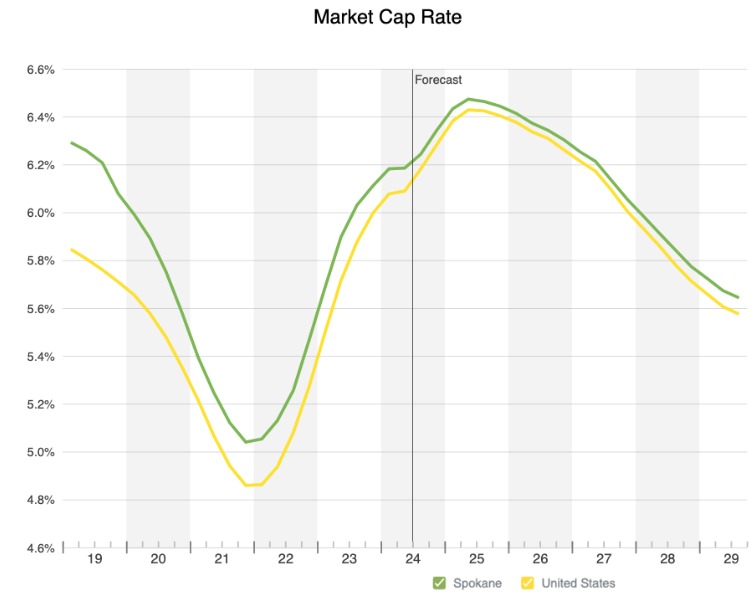

Multifamily cap rates have been increasing locally and nationwide since Q1 of 2022. In Q4 of 2021, cap rates reached historic lows of 5.04% on average in Spokane and 4.86% on average in the US. Currently in Q3 of 2024, cap rates sit at a 6.16% average in Spokane and a 6.09% average nationwide.

There have been several factors that have caused cap rates to increase over the last three years including:

- Interest rate increases

- Oversupply of apartments

- Rising Expenses

There appears to be signs of optimism on the horizon as of late, however. This is a great time to consider buying due to improved interest rates, an indication of more rate cuts later this year, and supply of apartments currently peaking.

Each deal is different and a cap rate should be evaluated on a case by case basis.

Currently, buyers are typically willing to pay a lower cap rate than market averages for newer construction due to:

- Less headache

- Cost of renovations have increased significantly

- Rents have not been increasing as much as of late post renovations

Traditional value-add deals can still be very profitable, but must be purchased at a number that sits around market averages for cap rates, something sellers are usually not always willing to accept. Heavy value-add deals with properties that have been run into the ground often go for above market cap rates.

Financing structure of a deal can also significantly impact what cap rate a buyer is willing to pay. Sellers willing to offer seller financing at attractive terms and numbers that work could potentially bring a buyer willing to pay a 4.5%-5.5% cap rate.

Personal Example: I sold a property at a 4.73% cap rate in late 2023 because the seller was willing to offer attractive seller financing terms.

If a buyer is looking to obtain a new loan through a traditional lender, they would likely need to be closer to that 6-7% cap rate range right now to make a deal work. Cap rates also don’t tell the full story, and many investors like to use other metrics to underwrite deals such as cash on cash return (CoC) or internal rate of return (IRR).

Please reach out for a valuation on your property, opportunities for buying, and information on recent sales comparables in the Spokane market.

SVN Cornerstone Multifamily Team

Jordan Lester, CCIM, MBA joined SVN Cornerstone as a Commercial Real Estate Broker in 2022. Jordan specializes in advising clients with the acquisition and disposition of multifamily investment properties. With a primary focus in Spokane County and an expert understanding of the latest market trends, Jordan is committed to maximizing his client’s financial goals to achieve their real estate objectives. Jordan began his real estate career as a broker’s assistant for three years with SVN Cornerstone, which gave him valuable knowledge and experience to jumpstart his career as a broker. To get in touch with Jordan, email jordan.lester@svn.com or call 509.496.6922