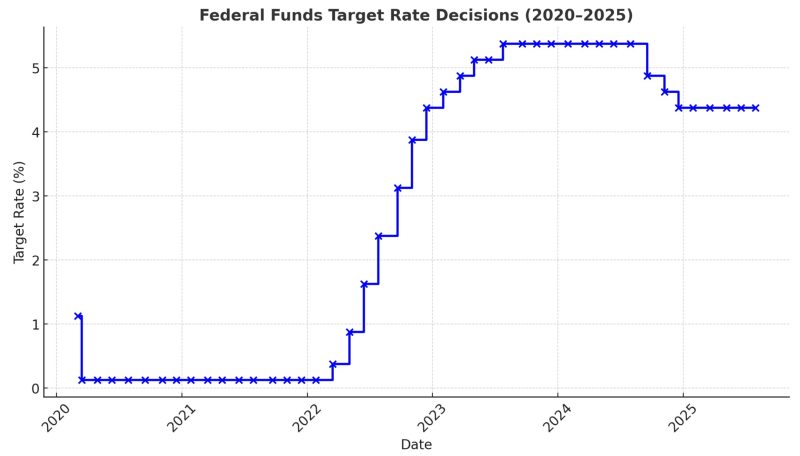

After holding rates steady since late 2024, following a rapid increase that pushed the federal funds rate to 5.25–5.50%, markets now expect the Federal Reserve to cut rates at its September 16-17 meeting. Fed Chair Jerome Powell’s recent comments at Jackson Hole, highlighting rising job risks even as inflation remains a concern, have shifted expectations toward a cut. Major banks, including Morgan Stanley, Barclays, BNP Paribas, and Deutsche Bank, forecast a 0.25% reduction, with futures markets showing a very high probability. This would bring the rate to around 4.00–4.25% and could mark the start of further cuts through year-end.

Below is a graph showing the federal funds rate from the beginning of 2020 through 2025. Although multifamily interest rates are directly tied to the 10-year Treasury yield rather than the federal funds rate, they tend to follow similar patterns, so projected Fed rate cuts should help lower borrowing costs, making apartment deals in Spokane more feasible for buyers.

Want to learn how I can help you with your business? Reach out today!

Jordan Lester, CCIM, MBA specializes in advising clients with the acquisition and disposition of multifamily investment properties. With a primary focus in Spokane County and an expert understanding of the latest market trends, Jordan is committed to maximizing his client’s financial goals to achieve their real estate objectives. Jordan began his real estate career as a broker’s assistant for three years with SVN Cornerstone, which gave him valuable knowledge and experience to jumpstart his career as a broker. To get in touch with Jordan, email jordan.lester@svn.com or call 509.496.6922